Feasibility Plus For You

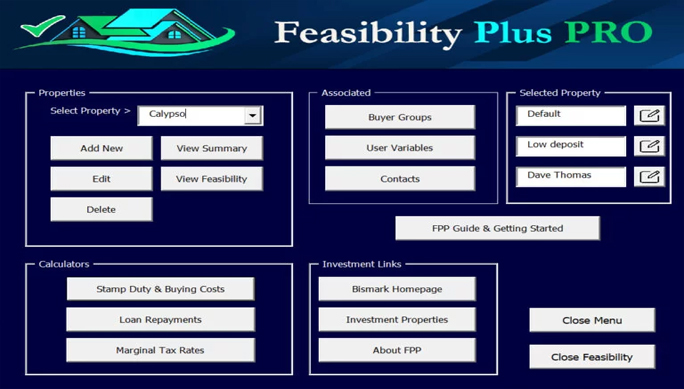

Feasibility Plus Pro is the ultimate tool for:

* Property Investors – enabling them to foresee cashflow over a 5 year period

* Estate Agents – Prepare investment feasibilities for each property

* Accountants – easily prepare analysis for clients

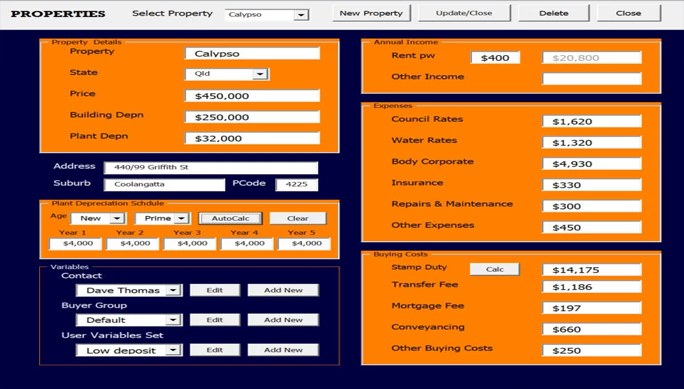

Simply enter the details of the:

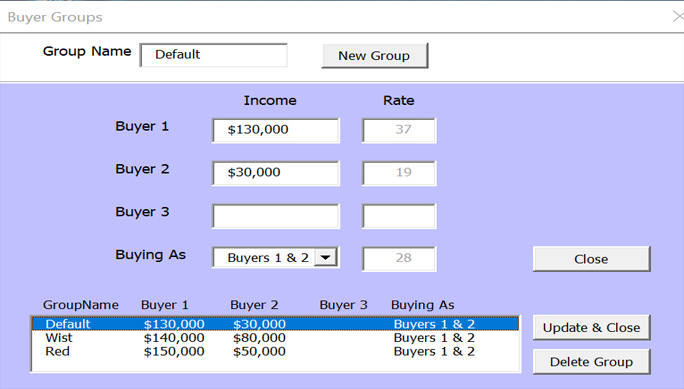

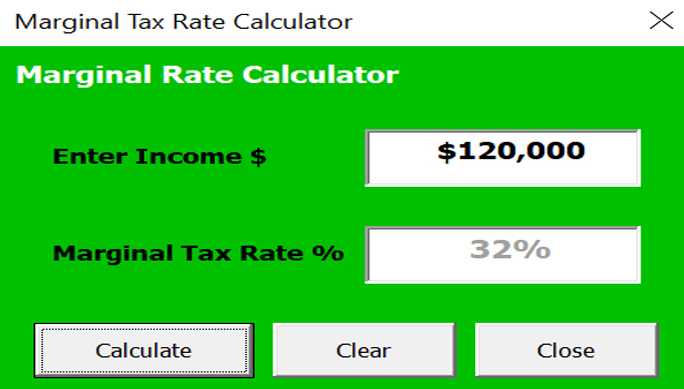

- Buyers – who are buying and their incomes

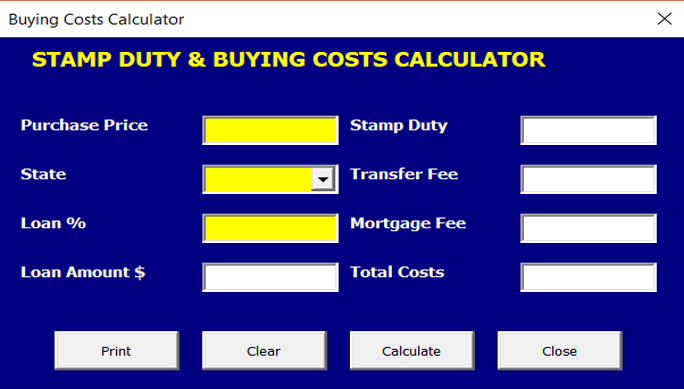

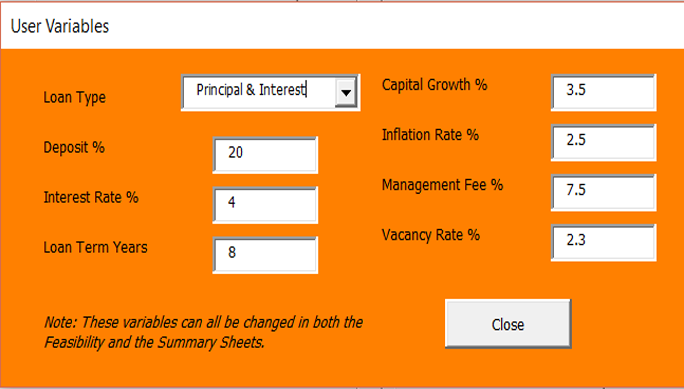

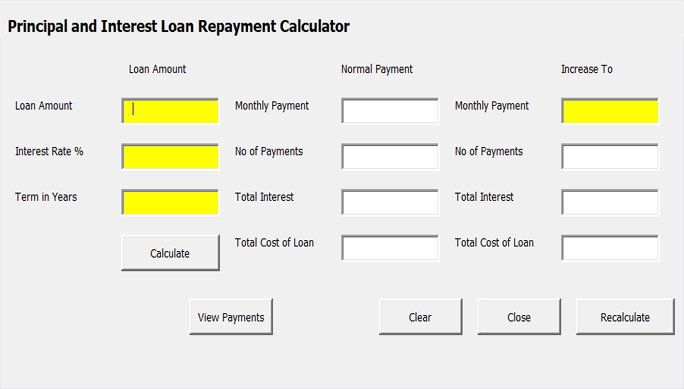

- Anticipated variables (such as loan %, interst rate, growth rate, inflation rate etc)

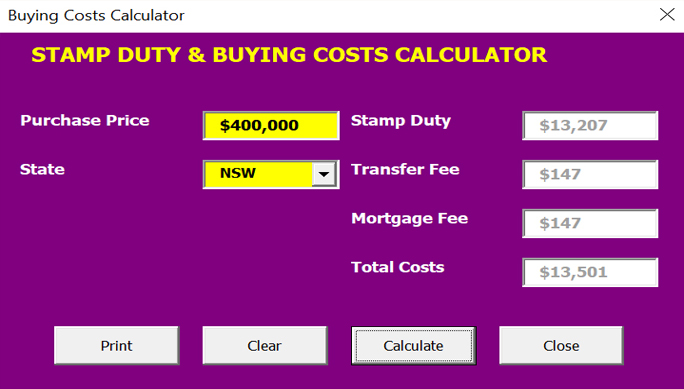

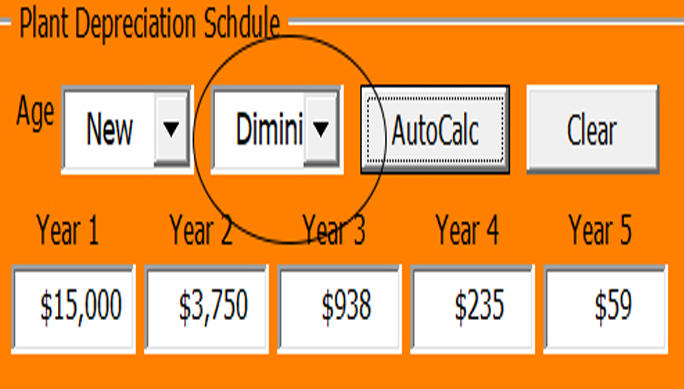

- Specific property details – purchase price, rent, expenses and depreciation (if applicable)

Then Feasibility Plus Pro will prepare a 5 year analysis of expected income and expenses allowing for tax benefits based on the buyers details.